Banking

The Czech banking sector is unique in many respects. Most of the sector is dominated by strong European financial groups and its activities are primarily focused on the Czech Republic.

Capital position

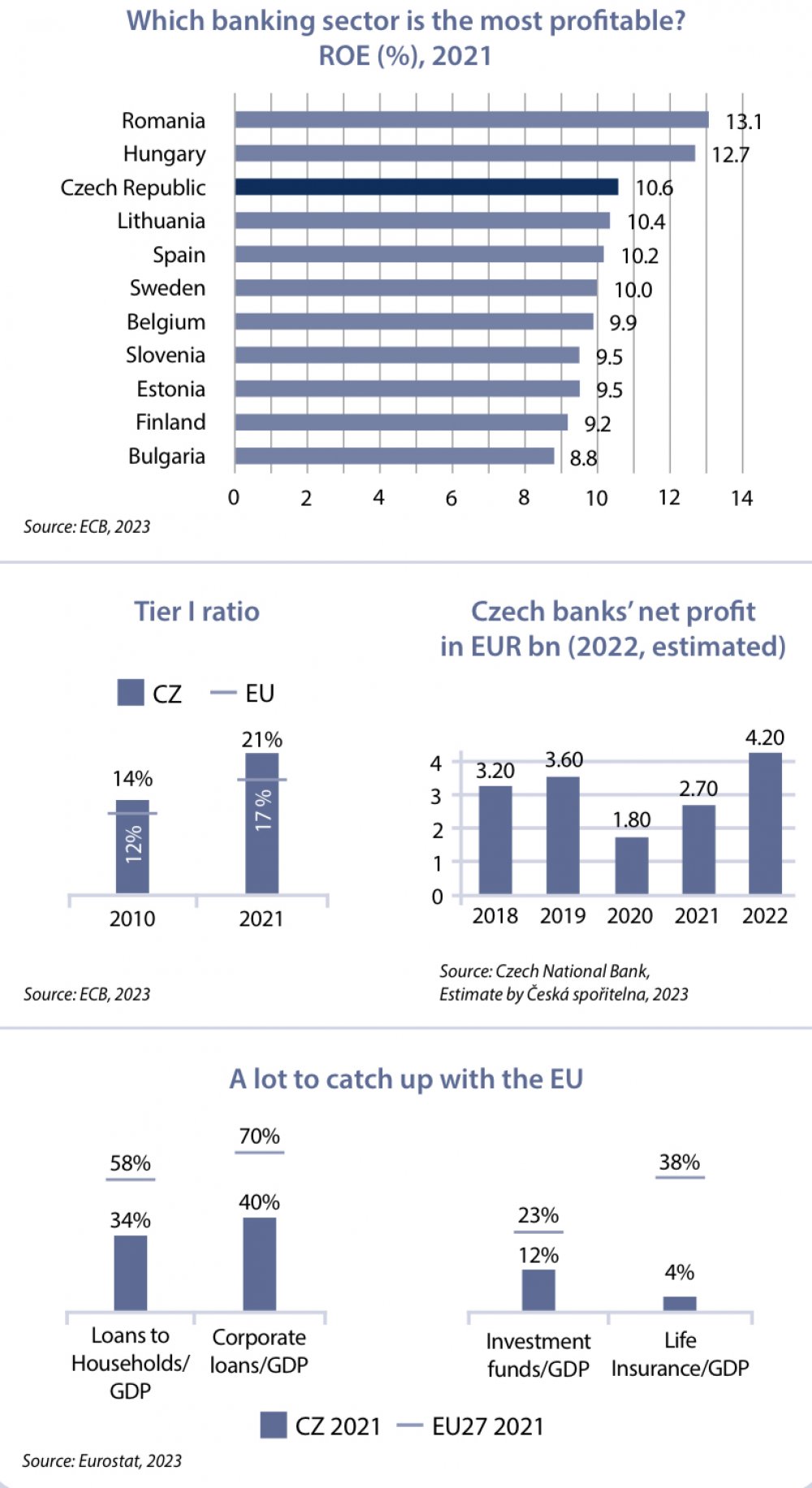

Czech banks remain well-capitalised despite the impressive growth they have shown over the past two decades, and the total level of capitalisation is well above all regulatory requirements. With capital adequacy at 24% (in 2021), Czech banks have maintained a solid position amid the COVID-19 pandemic, supported by solid risk profile and limited dividend payout. Czech banking sector remains well capitalized even after dividend payouts in 2022 and remains resilient against the economic impact of Russian invasion to the Ukraine thanks to its profitability and low exposure to both countries.

Profitability

Czech banks are among the most profitable in Europe. With ROE around 11% in the past decade (with the exception of ROEof 7% in pandemic year 2020), Czech banks have generated attractive returns for their shareholders in a global comparison. With net profit accounting for roughly 1.2% of GDP (2021), the Czech banking sector is among the most profitable when comparedto the size of the Czech economy supported by the benign environment including a strong macro picture, a prudent supervision and a friendly investment environment.Profitability has been under pressure during the COVID-19 pandemic, which translated into contraction of the economy in 2020. Nevertheless, Czech banks maintained a strong position without any need for state support and experienced a solid recoveryin 2021.

After a decline in 2020 (EUR 1.8 billion) net profit has been back on growing trajectory. Expected double digit increase in net profit in 2022 reflects the improving economy, lower risk provisions and an increasing interest rate environment resulting from CNB interest rate hikes and limited negative impact of the war in the Ukraine.

Efficiency

With costs between 45% to 49% of income over the past ten years, Czech banks have been among the most cost-efficient global- ly. Cost to income remained below 50% even during the COVID-19 pandemic.Apart from overall good cost control, banks benefit from economies of scale affected by the high market concentration (roughly two thirds of total assets are in the hands of the five biggest players). Elevated costs in 2022 remain well below the inflation level.

Asset quality

The asset quality slightly deteriorated in 2021, which was a reflection of the COVID-19 pandemic. Share of non-performing loans (NPL ratio) started to fall again in both the household and corporate sector thanks to a post-pandemic recovery of most of the economy and reached 2.0% at the end of 2022.

The currency split of loans in the Czech banking sector shows that foreign currency lending is mostly denominated in EUR and predominantly in the corporate segment where it becomes increasingly popular in 2022.

Opportunities

Further loan growth can be anticipated, as penetration still lags behind developed Europe; compared to other EU countries,the Czech market is still underpenetrated in both loans to households and corporate loans. In other words, the convergence story continues and there is still significant room to grow faster than the EU even in other product categories (e.g., investment funds and life insurance).

Despite all the challenges that 2022 brought, Czech banking sector confirmed its resilience and stability and managed to provide strong support to households, companies and the public sector and is ready to further contribute to stronger and sustainable society. The main risk for the future remains uncertainty about development with respect to war in the Ukraine.

| Juraj Garaj Head of Group Controlling and IR team Česká spořitelna |