Paying corporate taxes in the Czech Republic

Foreign and Czech companies operating within the Czech Republic will encounter obligations related to various taxes, including corporate income tax, VAT, and withholding tax.

Corporate income tax

Taxable Entities and Income

Entities subject to corporate taxation in the Czech Republic include both resident and non-resident companies with a permanent establishment. For tax residents, their total worldwide income is subject to income tax in the Czech Republic, with some exemptions and deductions easing the tax burden.

The tax base is derived from the annual profit calculated in accordance with Czech accounting principles, adjusted for non-tax-deductible expenses and non-taxable revenues.

In response to soaring energy prices, the Government introduced an additional "windfall tax" for years 2023 to 2025, targeting companies in the banking and energy sectors, focusing on their corporate income exceeding 120% of the average tax base reported from 2018 to 2021.

Rate

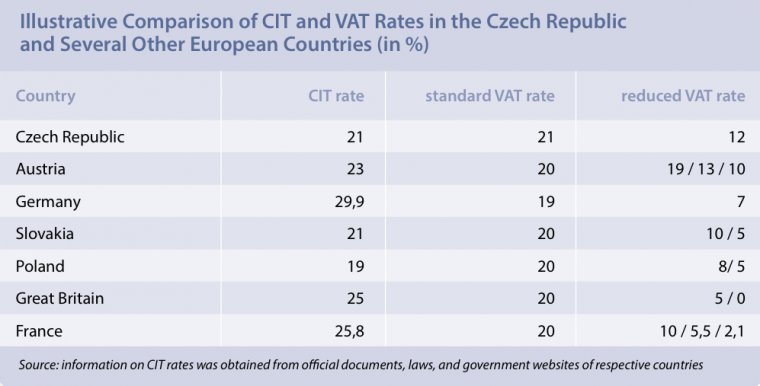

The Czech Republic maintains a competitive general corporate income tax (CIT) rate of 21% as at 2024. Certain exceptions to this general CIT rate exist, such as a special CIT rate of 5 % for certain investment funds and a 0 % CIT rate for pension funds.

Tax Incentives and Credits

Various incentives and tax credits, including research and development, investment incentives, and tax loss carry forwards and backwards, are offered to stimulate economic growth. Additionally, companies can reduce their tax liability through deductions for employees with disabilities and contributions to charitable purposes.

Transfer Pricing Considerations

In adherence to international standards, particularly OECD guidelines, the Czech Republic aims to prevent profit shifting among related entities. While not legally mandatory, transfer pricing documentation serves as a persuasive tool in resolving tax disputes.

Tax Compliance and Reporting

The tax year typically coincides with the calendar year or the fiscal year. Companies must file their annual tax returns generally within three months from the end of the year. In case of companies liable to statutory audit and companies using the services of tax advisors, the time limit is extended to six months.

Withholding tax

Dividends paid by Czech stock companies are generally subject to a 15% withholding tax. However, this rate is limited to profit distributions to residents of the Czech Republic and countries with which the Czech Republic has a double taxation treaty. In all other instances, a 35% rate applies. In specific cases, dividends may be exempt from tax or the standard 15% rate may be reduced under the terms of the applicable double taxation treaty.

In addition to dividends, interests and royalties are also subject to withholding tax.

VAT

VAT, a crucial part of Czech taxation, encompasses a standard rate of 21 % and reduced rate of 12 %. The reduced rate applies to specific goods and services such as foodstuffs, accommodation services, public transportation etc.

VAT payers must fulfil obligations such as filing VAT returns and EC Sales Lists for EU sales and submitting a VAT control statement (a detailed transactional VAT report).

|

Miroslav Kocman Josef Krátký |

|