Insurance

The insurance sector remained profitable and stable even during the period following the financial crisis of 2009 and it further remained stable and well capitalised during the COVID-19 pandemic in 2020 and 2021. It continues to be resilient in the current environment of high inflation and overall economic instability connected with ongoing war in Ukraine.

In addition, the insurance market still has significant room for further growth. In the Czech Republic, the combined share of premium billing in GDP was 2.9% for life and non-life insurance in 2022. This figure is approximately double in Western European countries.

Stability of the Czech insurance market

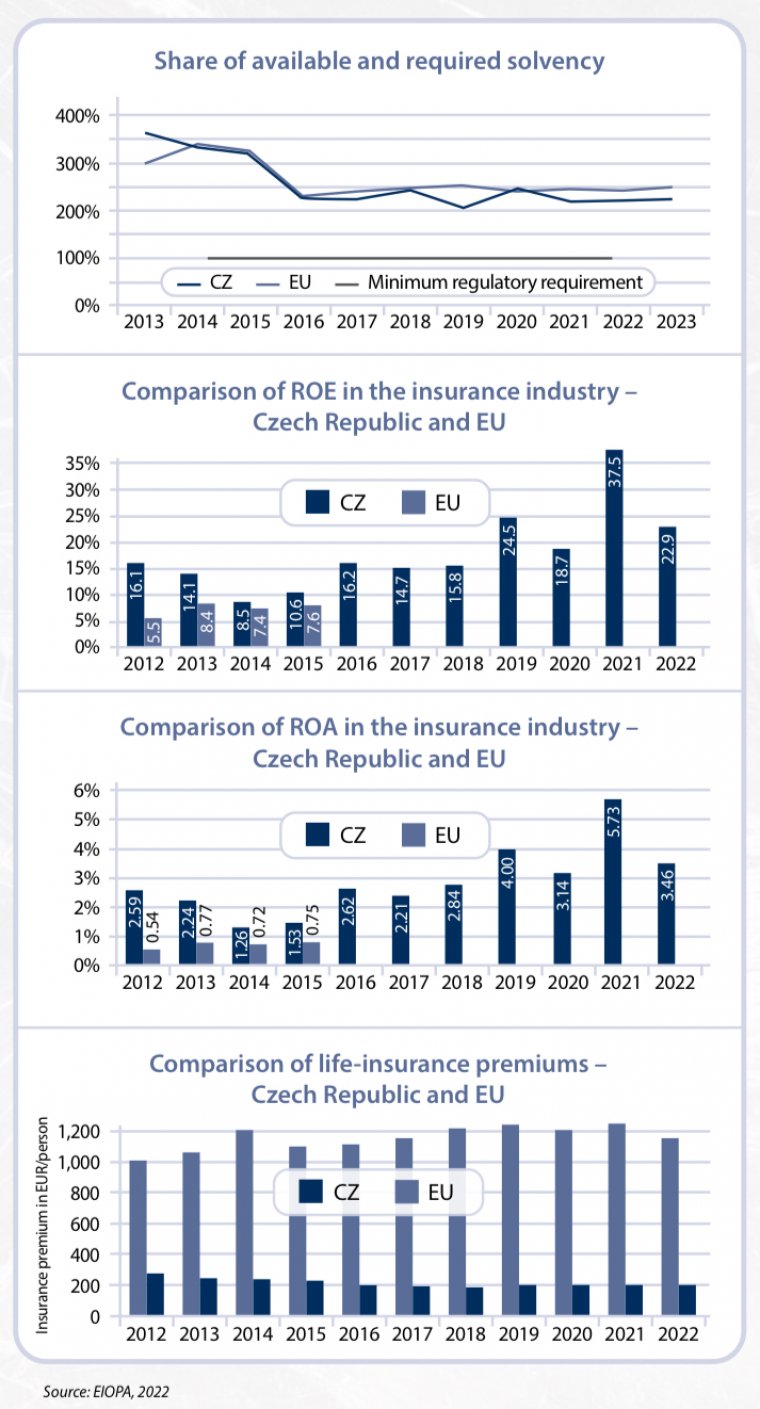

The Czech insurance market exhibits a high degree of stability and capital resilience. In comparison with the values for the EU as a whole, the Czech market consistently maintained a substantially higher solvency ratio in comparison to the minimal capital requirement defined by the regulator until implementation of Solvency II in 2016 (the solvency ratio for the Czech market resulted in approximately 330% of the minimal capital requirement, which in recent years has been fully comparable with the results of Europe as a whole due to an increase of capital adequacy in the overall EU data). No instability of the insurance market occurred during the transition to the new Solvency II regime. The market focused a great deal of attention on risk management in general and more specifically on the adequate and prudent setting of technical reserves. The introduction of Solvency II in 2016 affected the solvency ratio figures and thus data for the period up to 2015 and figures starting after 2016 are not comparable, as the solvency calculation methodology was adjusted significantly. However, the solvency ratio and overall capital adequacy are still at a very prudent level and more than double the regulatory requirements.

Moreover, regularly performed stress tests confirm that the Czech insurance sector remained solvent even under scenarios of significant economic recession connected with a high degree of capital market declines, as well as the higher level of lapses of insurance contracts due to adverse economic developments. So far, there have been no substantial impacts resulting from massive lapses after the pandemic and the associated adverse economic development. The Czech insurance sector has not only remained stable in terms of having sufficient capital, but has also successfully dealt with the issues of remote working, continuity of providing all services to clients and business partners and acceleration of the digital transformation of its products and services in the new situation.

High profitability in comparison with the EU average

The Czech insurance market’s profitability consistently exceeds the European average multiple times over in both the ROA (return on asset) and ROE (return on equity) indicators. The Czech insurance market did not suffer a substantial decrease in profits during the financial crisis and recession of 2008-2009, when profits in the European market as a whole were minimised. In fact, the profit figures partially improved even in the recent pandemic and post-pandemic periods.

Claims performance of non-life insurance

The claims ratio in non-life insurance was roughly 55% between 2017 and 2019. A further decrease occurred in 2020 with a 51% claims ratio, and there was no significant increase in 2022 (the latest available claims ratio results for Q1 2023 and Q2 2023 are 49% and 54%, respectively). Despite the existence and gradual increase of the severity of claims, these are still significantly lower claims ratio figures than those reached in the Europe-wide market, where this indicator for non-life insurance was approximately 65%-67% in the period from 2017 to 2019, with almost no reduction after 2020 (claim ratios of 66% in the period between 2020 and 2023).

Even though there is potential for further growth in non-life insurance (the basic difference in non-life insurance penetration is connected with the minimal share of commercial health insurance and long-term care in the Czech Republic), the main imbalance in the per-capita insurance penetration rate between the Czech Republic and the EU as a whole is seen in the area of life insurance.

Potential for further development of the life-insurance market

The average annual life-insurance premium in the EU was approximately EUR 1,148 per person in 2022. By comparison, this figure for the Czech Republic in 2022 reached only EUR 202, as growth of the average life-insurance premium in the country practically stalled in 2010.

The potential for further growth dealing with this significant gap in the life market between the Czech Republic and Europe is mostly connected in further development of risk protection in life insurance, life annuities in future pension reforms and the covering of long-term care risk.

| Petr Jedlička Team Leader of Actuarial and Analytical Services Czech Insurance Association petr.jedlicka@supin.cz www.cap.cz |